Federal Reserve Rate Hikes 2023: How Do They Affect Crypto?

There are a lot of things going on between the Fed and the financial markets. Find out how the markets are affected by changes in monetary policy and how do they affect crypto.

The Federal Reserve has been at the center of economic news for the past few years. After strong quantitative easing was used to fix the economic problems caused by the pandemic, interest rates are now being raised to fight high inflation.

Imagine this: It’s a nice Thursday afternoon in March, and Mike, an investor with not a lot of experience, logs into his Binance account. When he does, he sees that his Bitcoin long has been sold. He sighs, then yells, “What? Just an hour ago, it was going up well!”.

When he can’t figure out why the market crashed, he asks his more experienced trade friend, let’s call him Abdul, for help. After a short back-and-forth, Mike finds out that the Federal Reserve announced a 25-basis-point rate hike, which the market did not like.

There are lots of similar stories. Help Mike out by talking about how Fed rate hikes affect the cryptocurrency market.

How does the Federal Reserve work?

The Fed, or Federal Reserve, is an organization whose job is to keep the US economy going. It has three main goals as the central bank of the United States:

- Maximum employment

- Stable prices (i.e., low and stable inflation rate)

- Moderate interest rates in the US economy

Maximum employment: The Fed tries to create the most jobs that can be kept, taking into account things like job growth, labor force participation, and the jobless rate. By changing its monetary policies, the Fed can create an economic climate that helps create jobs and keeps the job market stable.

Stable prices: Keeping inflation under control is important for making the economy more stable, keeping money’s real value, and promoting long-term economic growth. As part of its job to keep prices stable, the Fed aims for an inflation rate of 2% over time.

Moderate interest rates in the US economy: Long-term interest rates should be kept at a reasonable level. Keeping long-term interest rates at a reasonable level can lead to steady economic growth and spending. By changing short-term interest rates, like the federal funds rate, the Fed can effectively change long-term rates and help keep the financial world stable and healthy.

In other words, the Federal Reserve needs to make sure that prices stay steady and that new jobs can be made. To do this, it keeps an eye on the risks in the economy and changes the monetary policy often.

Also Read: UFO-like swirls over Alaska On the night of a Northern Lights show 🛸

What is the policy of money?

Monetary policy is the set of rules that a country’s central bank makes to control the flow of money into the economy and reach the main goals we just talked about (maximum employment, low and stable inflation, and reasonable interest rates).

Monetary policy can be changed by central banks to fight inflation and rising prices, make more jobs available, or lessen the effects of a slump. In this way, monetary policy can be thought of as a set of tools that central banks can use to move the economy in the direction they want.

Quantitative easing, open market operations, changes in interest rates, and reserve requirements are the most well-known tools in monetary policy, but central banks can use a lot more.

What is a meeting of the FOMC?

At least eight times a year, the Federal Open Market Committee (FOMC) gets together. The FOMC could hold more emergency meetings if the scenario calls for it. This happened most recently after the bank run crisis that hit two of the biggest US banks.

At the meetings, FOMC members talk about the economy and any possible risks it faces. They also talk about whether the economy needs a change in monetary policy. This became clear when the pandemic hit and the Federal Reserve started pumping money into the economy at rates that had never been seen before. Even though this helped solve problems in the short term, it also caused inflation to rise, reaching a peak of 9.1% year-over-year in June 2022.

Also Read: Fossil fish have been found in the high-altitude on the Himalayas!

Since then, the FOMC has been trying to bring prices back down by raising interest rates, which can hurt jobs and lead to a recession. As you can see, the FOMC has a hard job.

What is a rise in the interest rate?

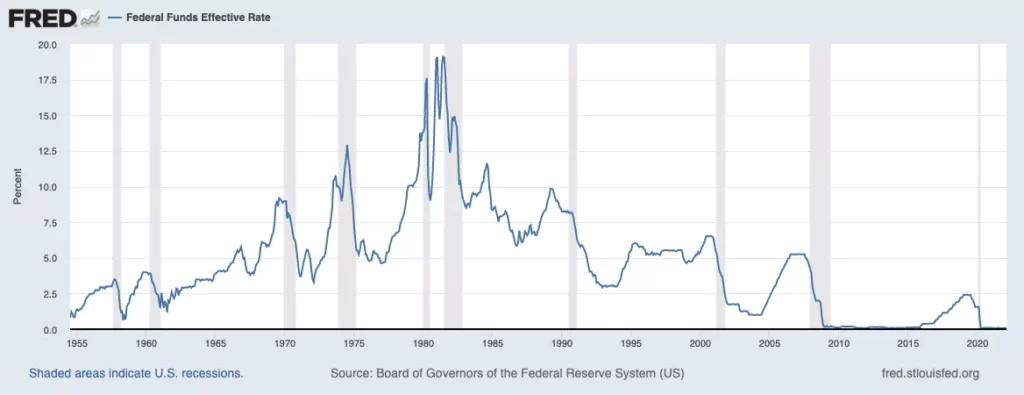

Back to raising interest rates! When we say “the interest rate went up,” we mean that the federal funds rate went up. This is the interest rate that commercial banks use to borrow and give money to each other overnight. The federal funds rate is a range of interest rates that banks can use when they give or borrow money.

Since inflation got out of hand, the Federal Open Market Committee (FOMC) has raised interest rates nine times, taking them from 0.25 percent to 5 percent in just over a year.

At the time this piece was written, the federal funds rate was between 4.75 and 5 percent.

The cost of cash goes up when the federal funds rate goes up. It makes it more expensive for banks to borrow money, so they charge their customers more in interest. The cost of mortgages goes up, and the cost of business loans and credit card debt charges goes through the roof. In other words, when the Fed raises interest rates, it costs more to invest or spend money. This makes the demand curve go down.

If you’ve studied economics, you know that when demand drops, prices usually go down. Using rate hikes to bring down prices (and, by extension, inflation) is like putting out a fire with a fire extinguisher.

Do increases in interest rates affect the markets for crypto?

Changing the federal funds rate doesn’t just help fight inflation; it also has affects on the whole economy, including the financial markets. Changes in the federal funds rate have a history of making the stock market move a lot. For example, when the Fed cuts interest rates, the cost of doing business usually goes down, which makes it easier for openly traded companies to make money.

On the other hand, when interest rates go up, share prices tend to go down because the cost of doing business goes up, which reduces profits. Because stock markets and crypto are linked, a drop in the stock market also means a drop in the value of your tokens.

But the biggest effects of rate hikes in the short run are mental. The markets are very good at putting prices on new information, and they often move before FOMC decisions. For example, on March 22, the market went up because people thought that rate hikes would stop for a while. When the FED stated that it would raise rates by 25 basis points, the price of Bitcoin went down by 7.9%.

At the beginning of this run of rate hikes, the news of a 25-basis-point increase came as a surprise. This caused a strong sell-off. Now that we’ve had nine rate hikes in a row, the effect of a new rate hike isn’t as big as it used to be. Even though it still causes a fair amount of volatility, the market usually corrects itself quite well, getting it back to the level it was at before the rate hike was announced. Rate hikes have become normal for the market.

Some Final Thoughts

Overall, it’s clear that the Fed has a big impact on the financial markets. Their quantitative easing program drove asset prices to all-time highs in 2021 but moves to raise interest rates have sent prices back down over the past year.

At this point, the market is used to rate hikes, and they have less of an effect on short-term prices. It is very hard to guess what will happen with interest rates and even harder to guess how they will affect the market. Still, it’s helpful to have a basic idea of what makes economies work. This will help you figure out why markets move the way they do.

Disclaimer: This article is based on our limited knowledge and experience. It has been written for educational purposes. Past performance is not a guarantee of future results, and investors may lose some or all of their investments. It is recommended to seek professional advice before making any investment decisions.

Click here to go to the Homepage

Keep Tuned with mojbuzz.com for more Entertainment